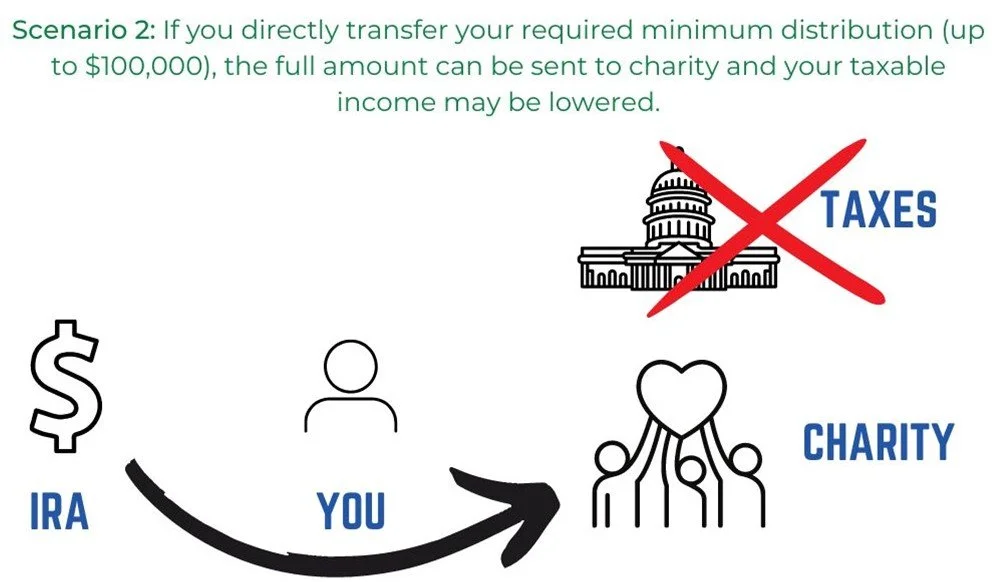

Required Minimum Distributions and Charitable Giving

If you are of the age that you have to take a required minimum distribution (RMD) from your IRA, 401k, 403b, or other qualified plan, did you know that you can transfer any amount (up to $100,000 each year) directly to a qualified charity like R.M. Pyles Boys Camp?

IRS Tax Tip 2022-171 says, “Seniors can reduce their tax burden by donating to charity through their IRA.”

We’ve compiled some helpful information below, however it is recommended that you discuss this with your tax consultant, legal counsel, or other qualified professional prior to making any decisions.

Why?

A direct rollover to a qualified charity can qualify as your RMD and may prevent this withdrawal from being included as taxable income. This strategy can lead to a larger charitable gift AND lower taxable income compared to withdrawing the funds into your account and then making a charitable gift later.

Who?

If your 70th birthday is July 1, 2019 or later, you do not have to take withdrawals until you reach age 72. If your 70th birthday is before July 1, 2019, you must take RMDs starting at age 70½.

Individuals can still make Qualified Charitable Distributions (QCDs) from their IRAs as early as age 70½.

How?

You can donate a portion of your RMD to several different charities and you do not need to donate the entire amount of the RMD to charities. You may want to discuss with your plan manager the strategy of making the check out to the charity and using your address on the check so you can forward the check to the charity along with any correspondence you wish to include.

Please view Qualified Charitable Distribution (QCD) Guidelines from IRS Tax Tip 2022-171 for details.

External Resources:

Please note: R.M. Pyles Boys Camp does not intend the above to be legal advice and recommends you discuss this with your tax consultant, legal counsel, or other qualified professional.